accumulated earnings tax reasonable business needs

Reasonable business needs versus tax avoidance by Machinery and Allied Products Institute 1967 edition in English It looks like youre offline. An accumulation of the earnings and profits including the undistributed earnings and profits of prior years is in excess of the reasonable needs of the business if it exceeds the amount that.

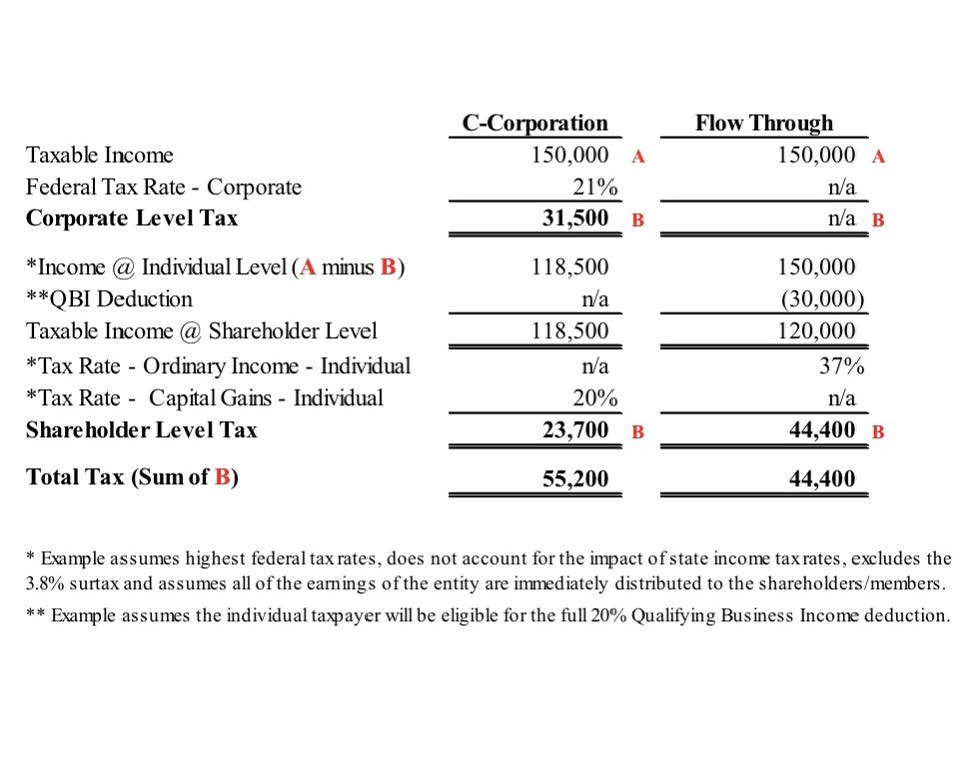

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company

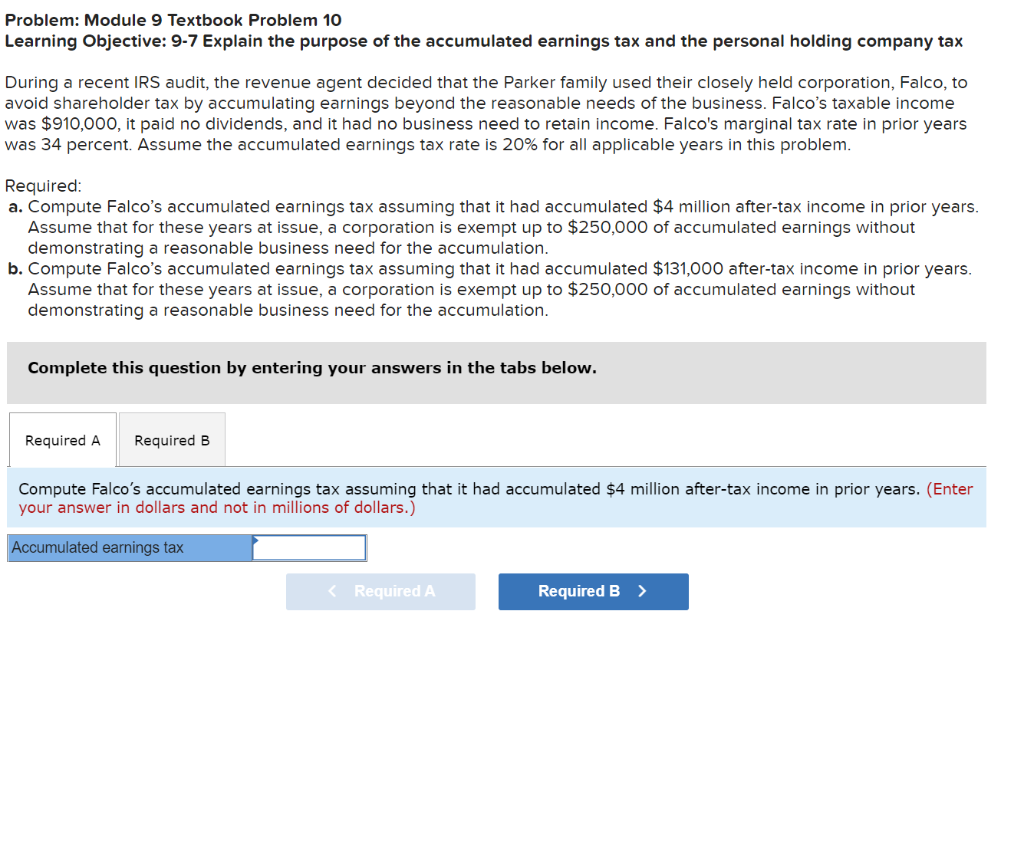

The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation.

. The accumulation of reasonable amounts for the payment of reasonably anticipated product liability losses as defined in section 172 f as in effect before the date of enactment of the. The AET is a penalty tax imposed. The 531 penalty tax is designed to prevent corporations from unreasonably retaining after-tax liquid funds in lieu of paying current dividends to shareholders where they.

Within the reasonable needs of the business rubric. UNREASONABLE ACCUMULATION IS EVIDENCE OF PURPOSE TO AVOID TAX. Tion 303 relating to payment of a deceased.

Once again the tax can be levied if the IRS identifies that a corporation is withholding dividends and accumulating earnings for reasons other than reasonable needs of. The key term reasonable needs of the business is so subjective in nature that the tax itself is de facto raised by the IRS. Reasonable business needs versus tax avoidance Machinery and Allied Products Institute and Council for Technological Advancement.

For a business to avoid this tax it must demonstrate that the profits carried forward do not exceed the limits of reasonable business needs. Corporations do not tax accrued income. The tax is assessed at the highest individual tax rate.

Anticipated needs of the business. According to the Internal Revenue Code the fact that the earnings and profits of a corporation. The accumulated earnings tax doesnt apply to earnings kept in the business to meet the reasonable needs of the business.

However this opens the door to the Accumulated Earnings Tax AET if profits accumulate beyond the reasonable needs of the business. 2 redemptions in connection with sec-. This tax is raised and imposed by the IRS whereas.

This taxadded as a penalty to a companys income tax liabilityspecifically applies to the companys taxable income less the deduction for dividends paid and a standard accumulated. Essentially the accumulated earnings tax is a 15. In any proceeding before the Tax Court involving the allegation that a corporation has permitted its earnings and profits to accumulate beyond reasonable business needs the.

The accumulated earnings tax which is imposed on corporations for the accumulation of earnings in excess of reasonable business needs does not apply to. The accumulated earnings tax. The accumulated earnings tax.

The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends.

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc

9 Facts About Pass Through Businesses

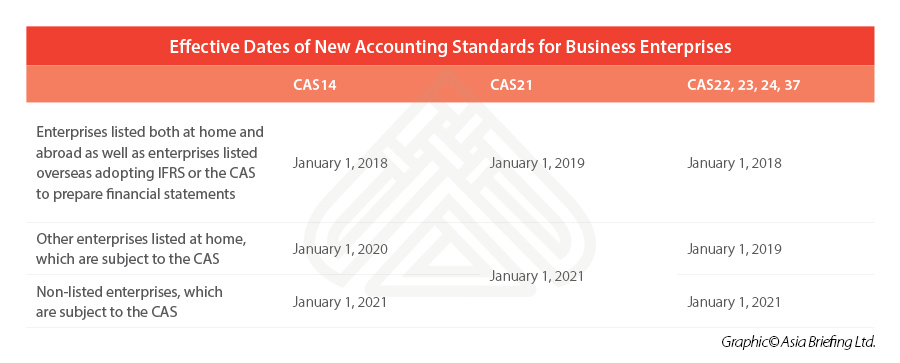

Doing Business In The United States Federal Tax Issues Pwc

Basic Principles Of Taxation Pdf Income Tax Dividend

:max_bytes(150000):strip_icc()/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

Determining The Taxability Of S Corporation Distributions Part I

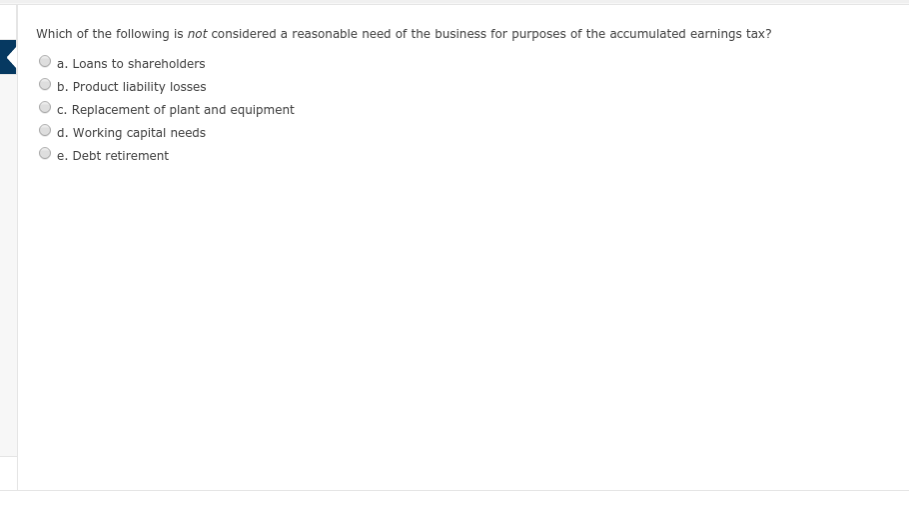

Which Of The Following Is Not Considered A Reasonable Chegg Com

Retained Earnings Normal Balance Bookstime

Business Income And Business Taxation In The United States Since The 1950s Tax Policy And The Economy Vol 31 No 1

Solved In Each Of The Following Independent Situations Relating To The Penalty Tax Under 531 Determine The Dividend The Corporation Would Have To Course Hero

S And C Corporations Create Different Tax Consequences Wolters Kluwer

Double Taxation Of Corporate Income In The United States And The Oecd

Solved Problem Module 9 Textbook Problem 10 Learning Chegg Com

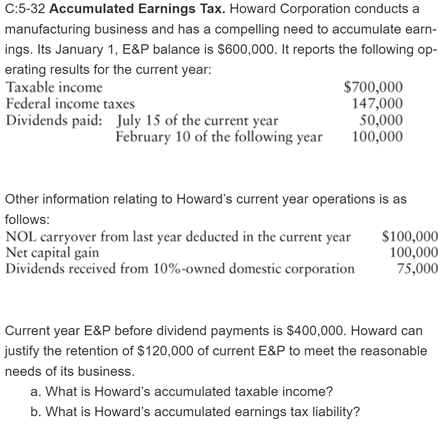

Solved C 5 32 Accumulated Earnings Tax Howard Corporation Chegg Com

The Dual Tax Burden Of S Corporations Tax Foundation

Instructions For Form 5471 01 2022 Internal Revenue Service

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

Fundamentals Of Federal Taxation Key Terms Chapter 17 Key Terms Accumulated Earnings Tax A Studocu

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc